News

Spouse super contributions - what are the benefits?

Spouse super contributions can boost retirement savings and reduce tax. Learn who’s eligible and how to make the most of the rules.

... read moreAm I too old to get a home loan?

Wondering if you’re too old for a home loan? Here’s what lenders really look for, what you need to show, and how to strengthen your application.

... read moreInstant asset write-off threshold finally confirmed

The instant asset write-off threshold for 2025 has been confirmed at $20,000. Understand how your small business can benefit before it drops again.

... read moreWhat Is Aged Care? Understanding Services in Australia

Aged care in Australia includes home, residential, and short-term services for older people. Learn about the options, eligibility, and costs involved.

... read moreThe ATO's updated small business benchmarking tool

The ATO’s updated small business benchmarking tool lets you compare your business performance and spot improvement areas. Stay informed and reduce ATO scrutiny.

... read moreYear-end tax planning opportunities & risks

Explore year-end tax planning opportunities and risks before EOFY. From super contributions to deductions and ATO red flags, make informed decisions now.

... read moreProperty subdivision projects: the tax implications

Property subdivision tax implications are often misunderstood. This article outlines key income tax and GST consequences you should know before starting.

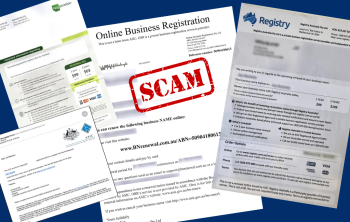

... read moreBusiness Name Renewal Scam - Avoid Costly Mistakes

Our guide explains how a business name renewal scam can trick Australian businesses. Learn how to identify the red flags and protect your business.

... read more