The United Kingdom Votes

Leave Campaign wins the Referendum

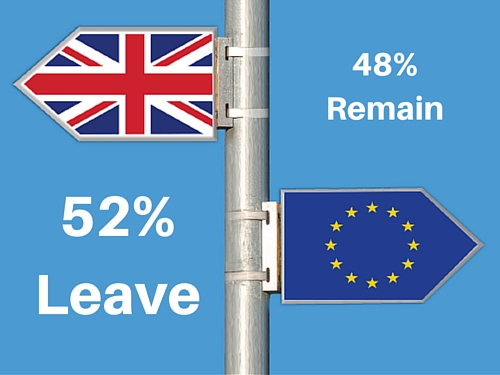

The United Kingdom (UK) has voted to leave the European Union (EU) in a shock decision that has sent global markets plummeting. It has been over 40 years since the UK last voted to stay in the EU and sentiment towards the common market has shifted dramatically. Whilst the margin was narrow (52%/48% at the time of writing), it is a far cry from the 1975 decision to stay in the EU by 67% to 33%.

Concerns regarding EU membership have boiled over and the decision to leave means majority of the population are concerned about the following statements:

- The EU is struggling to address the migrant crisis and the UK cannot control its borders.

- EU law is restricting trade deals and relationships with nations outside the EU.

- Funds contributed to the EU could be spent on national priorities such as education, national health services and housing.

- EU is restricting national sovereignty.

Concerns regarding EU membership are evidently at the front of mind for 52% of UK’s population, but many statements made by the Brexit campaign have been overstated in order to conjure doubt within the UK as to whether EU membership is beneficial. Whilst the UK have voted to leave, we believe that economically the UK currently receives more value from the relationship than it will from the imminent exit. There is no doubt that EU membership and being able to trade freely across the EU contributes to better job prospects and security within the UK. Additionally, the vote to leave will create an economic shock that is likely to cause public spending cuts, job losses and financial insecurity.

The UK exit from the EU is a significant risk facing the global economy and skews risk to the downside globally. The EU exit will impact the UK economy through trade barriers with the EU and a fall in foreign direct investment as a result of higher trade costs. This will impact growth in the region and force the European Central Bank to undertake further monetary policy easing, and it will also likely see the Bank of England and the US Fed delay monetary policy tightening.

Long term risks of the EU exit will depend on the post-exit relationship between the UK and EU. Global markets will be negatively impacted furthermore if the relationship is one that restricts trade between non EU and EU members. A free trade agreement will most likely be implemented but the trade benefits of staying in the EU outweigh current free trade agreement models. UK growth will be further impacted if the free movement of labour is obstructed, particularly for lower skilled workers. Majority of the risk though is associated with the impact on market sentiment.

The leave vote has created more uncertainty in financial markets and as a result safe haven assets such as gold and bonds have rallied. Gold broke through US1,360 as investors flooded to the asset in order to protect their investments. There was also a ‘flight to quality’ in bond markets as investors sought shelter in perceived higher quality bond markets such as Germany, France and the US. This drove German Bund 2 and 5 year yields into negative territory. The implication of the leave vote has sent global equities plummeting, in particular companies with revenue exposure to the UK.

ASX listed companies with revenue exposure to the UK economy are particularly impacted. Companies in the financial sector within this group have experienced the greatest impact on fears that investors will not be comfortable engaging the UK equity market which is likely to see outflows from UK funds. Financials are also heavily reliant on the free movement of labour within the EU and additionally, banking within the EU is currently possible by EU legislation. The vote to leave has created uncertainty regarding these issues.

The GBP and EUR have plummeted as anticipated in the event of the leave vote, with the GBP falling to levels not seen since 1985. We however don’t believe that a recession in the UK is likely because the UK’s fiscal position is improving and a weaker GBP is beneficial to exporters and will improve the UK’s trade balance. The USD has appreciated and is putting downward pressure on commodity prices which may trigger further RBA rate cuts along with a falling AUD as global markets turn risk off.

A UK withdrawal from the EU has a 2 year negotiation deadline under Article 50 of the Lisbon treaty with the possibility of extension so it should be noted that the UK is not leaving the EU immediately. The greatest impact is on market sentiment rather than the economic effects of an exit. UK economic fundamentals will likely remain strong and the period of negotiation will see the UK gain access to the common market without significant trouble. A major concern of the leave vote is that it raises questions over the implementation of structural reforms and the possibility of an EU breakup.

It is likely that a number of other EU nations such as Sweden and the Netherlands will express interest in holding similar referendums. Additionally, it is also possible that the vote to leave will strengthen the separatists in Scotland who could petition for admission to the EU or a second Scottish Independence referendum. Prime Minister David Cameron staked his reputation on keeping the UK in the EU and resigned in the wake of the referendum outcome.

Paris Financial

Suite 5/2-6 Albert Street

Blackburn VIC 3130

T: 03 8393 1000

Source: IOOF. Paris Financial Services Pty Ltd is a Corporate Authorised Representative (No. 357928) of Capstone Financial Planning Pty Ltd. ABN 24 093 733 969. AFSL / ACL No. 223135. Information contained in this document is of a general nature only. It does not constitute financial or taxation advice. The information does not take into account your objectives, needs and circumstances. We recommend that you obtain investment and taxation advice specific to your investment objectives, financial situation and particular needs before making any investment decision or acting on any of the information contained in this document. Subject to law, Capstone Financial Planning nor their directors, employees or authorised representatives gives any representation or warranty as to the reliability, accuracy or completeness of the information; or accepts any responsibility for any person acting, or refraining from acting, on the basis of the information contained in this document.