Superannuation

Super Tax Shake-Up: Big Balances Beware

The Government’s revised Division 296 super tax targets earnings on very large balances with a simpler, tiered model and a start date of 1 July 2026. Learn what changes, who is affected, and how to plan.

... read moreAccessing superannuation funds for medical treatment or financial hardship

Superannuation can be accessed early only in limited cases such as financial hardship or compassionate grounds. This article explains the conditions, ATO requirements, and risks of doing so incorrectly.

... read moreSuperannuation rates and thresholds updates

From 1 July 2025, the super guarantee rate 12% officially applies to all eligible employees. This change impacts payroll software, employment contracts, and cash flow. Employers must ensure compliance to avoid penalties and missed tax deductions.

... read moreDiv 296 super tax and practical things to consider

The proposed Division 296 super tax applies to individuals with over $3 million in superannuation. Understand the tax rules, examples, and how to prepare.

... read moreSMSF Tax Deductions: What You Can (and Can't) Claim

Get clear on SMSF tax deductions with our guide on what your self-managed super fund can legitimately claim and what it can’t.

... read moreSpouse super contributions - what are the benefits?

Spouse super contributions can boost retirement savings and reduce tax. Learn who’s eligible and how to make the most of the rules.

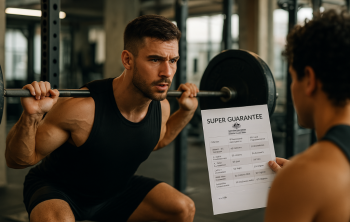

... read moreSuper guarantee rules catch up with venues and gyms

The super guarantee rules are broader than many realise. This guide covers what gyms, venues, and employers must know to stay compliant with SG laws, including how entertainers and contractors are affected.

... read moreIs there a problem paying your super when you die?

The ATO is scrutinising delays in paying super after death, with complaints rising. Ensure your super reaches the right hands with the correct nomination.

... read more