Archive for category: Tax

News

From air fryers to swimwear: Tax deductions to avoid

From air fryers to swimwear, the ATO is cracking down on work-related deductions that don't pass the test. Find out what to avoid and how to stay compliant.

... read moreATO Interest Charges May Soon Be Non-Deductible: What You Need to Know

From 1 July 2025, ATO interest charges such as GIC and SIC will no longer be deductible. Find out what’s changing and how your business can prepare.

... read moreInstant asset write-off threshold finally confirmed

The instant asset write-off threshold for 2025 has been confirmed at $20,000. Understand how your small business can benefit before it drops again.

... read moreThe ATO's updated small business benchmarking tool

The ATO’s updated small business benchmarking tool lets you compare your business performance and spot improvement areas. Stay informed and reduce ATO scrutiny.

... read moreYear-end tax planning opportunities & risks

Explore year-end tax planning opportunities and risks before EOFY. From super contributions to deductions and ATO red flags, make informed decisions now.

... read moreThreshold for tax-free retirement super increases

The transfer balance cap will increase to $2 million from 1 July 2025. Discover how this change to tax-free retirement super affects your plans, whether you're about to retire or already drawing a pension.

... read morePersonal tax cuts

From 1 July 2026, personal tax cuts will reduce rates for low to middle-income earners. Medicare levy thresholds have also increased. Learn what this means for you.

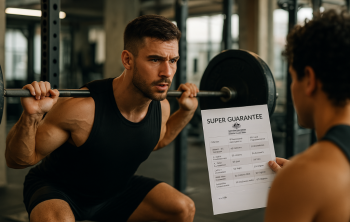

... read moreSuper guarantee rules catch up with venues and gyms

The super guarantee rules are broader than many realise. This guide covers what gyms, venues, and employers must know to stay compliant with SG laws, including how entertainers and contractors are affected.

... read more